Ever wondered, Why do I need Travel Insurance? In this article we will explain all the intricacies of travel insurance and why it is so important.

Embarking on a journey, whether for business or pleasure, carries with it the promise of new experiences and memorable adventures. Yet, amidst the excitement of choosing destinations and making travel arrangements, there’s a crucial element that often gets overlooked – travel insurance. Beyond safeguarding against medical emergencies, travel insurance extends its protective embrace to cover a spectrum of unforeseen events, from trip cancellations to lost luggage and even providing emergency cash in the event of a misplaced wallet.

Let’s delve into the often-underappreciated realm of travel insurance, exploring its multifaceted benefits and shedding light on how it goes beyond the conventional notions of coverage. Having witnessed firsthand the indispensable role insurance plays, drawing from my experience as both a travel professional and an avid explorer, I’ll share insights into why this financial safeguard is an absolute necessity in today’s unpredictable world.

Is Travel Insurance Worth It?

One key lesson learned from my travels is that the true essence of travel insurance lies in integrating it seamlessly into your trip costs. By doing so, decisions are no longer influenced solely by financial considerations but are guided by the assurance and peace of mind that travel insurance affords. In times of economic restraint, it’s common to scrutinize expenses, but insurance stands out as a protection you simply can’t afford to lose.

Like this article read more from expat family living below!

Traveling with Kids: The Ultimate Guide to Must-Have Baby and Toddler Gear for Stress-Free Journeys

How To Travel With Kids: Tips, Tricks, and Must-Haves For Every Family Vacation

In the upcoming sections, we’ll uncover the myriad benefits of travel insurance, shedding light on unexpected coverages that may surprise you. From medical contingencies to trip disruptions and the security of your belongings, insurance proves to be an invaluable companion for any globetrotter. As we navigate through the details, we’ll underscore the importance of peace of mind, reminding you that your policy is not just a document but a guarantee of security during your travels.

As you plan your next adventure, let this article serve as a comprehensive guide to the often-overlooked but essential component of any itinerary – travel insurance. Together, we’ll unravel how this financial safety net ensures you’re not only prepared for the expected but fortified against the unexpected, allowing you to embrace your journey with the confidence that comes from being well-protected.

What is Travel Insurance?

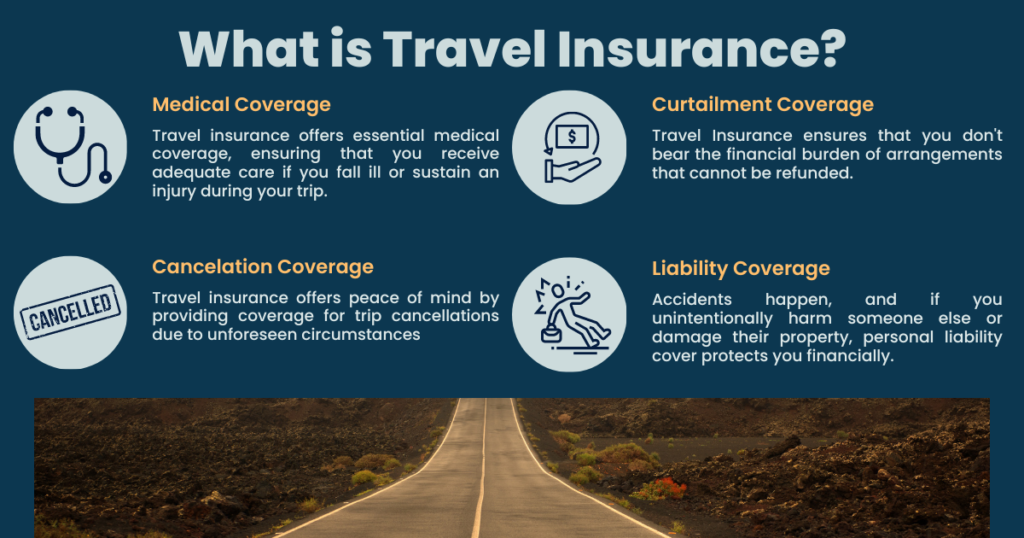

Travel insurance is a crucial financial safety net that offers protection against unforeseen events and emergencies that can disrupt your journey. It serves as a comprehensive shield, providing coverage for various incidents that may occur while you’re away from home.

Primarily, travel insurance offers essential medical coverage, ensuring that you receive adequate care if you fall ill or sustain an injury during your trip. This is especially vital as most health programs do not extend their coverage overseas, leaving travelers vulnerable to potentially high medical expenses. In addition to medical protection, travel insurance also steps in to offer reimbursement in cases of theft, such as the unfortunate loss of a new mobile phone, or unexpected cancellations of flights.

Moreover, travel insurance goes beyond the immediate concerns of personal well-being by considering the broader spectrum of potential emergencies. In the unfortunate event of a family member’s demise, requiring your immediate return, insurance provides the necessary financial support to facilitate your journey home.

But My Credit Card Has Travel Coverage!

One notable aspect is that conventional health programs and credit cards often offer minimal protection for travelers, emphasizing the importance of investing in dedicated travel insurance. Unlike life insurance and medical insurance, which typically have a broader scope, travel insurance is specifically tailored to cover incidents occurring during the duration of your travels.

The coverage provided by travel insurance encompasses a wide range of possibilities, including the loss of a passport, coverage for personal belongings, and compensation for the loss of checked-in baggage. This comprehensive protection ensures that you are financially safeguarded against unexpected setbacks, allowing you to navigate your adventures with confidence and peace of mind.

In essence, travel insurance is not just a prudent choice; it is a necessary investment for anyone embarking on a journey, providing the assurance that, in the face of unforeseen circumstances, financial support and coverage will be readily available.

Why Do I Need Travel Insurance: 14 Great Reasons

Travel insurance is a fundamental aspect of vacation planning, providing a safety net against the unexpected and ensuring that your travel experience remains smooth and worry-free. Here are compelling reasons why you need travel insurance for all your vacations:

Cancellation Cover Before Your Trip

- Travel insurance offers peace of mind by providing coverage for trip cancellations due to unforeseen circumstances such as family or medical emergencies. This means you can claim back non-refundable trip costs, allowing you to reschedule or recover your funds.

Trip Curtailment Coverage

- If your journey is unexpectedly cut short due to unforeseen events, insurance steps in to cover expenses you have already paid out, including hotel bookings, car rentals, and pre-booked activities. This ensures that you don’t bear the financial burden of arrangements that cannot be refunded.

Personal Liability Coverage

- Accidents happen, and if you unintentionally harm someone else or damage their property, personal liability cover protects you financially.

Legal costs abroad can be exorbitant, making this coverage a crucial component of your travel insurance.

Legal Expenses for Compensation Claims

- In the unfortunate event of an injury or accident overseas leading to a compensation claim, travel insurance may cover the associated legal fees. This ensures that you are protected from the potentially high costs involved in pursuing a claim.

Medical Evacuation and Repatriation

- Travel insurance provides coverage for transportation to the hospital and repatriation, ensuring that you receive medical attention promptly. In the case of medical emergencies, including accidents, illnesses, or unexpected injuries, this coverage can be a financial lifeline.

Protection Against Loss

- Travel insurance safeguards you against unexpected incidents such as theft, particularly in locations known for pickpocketing. Whether it’s personal belongings or important documents, having coverage ensures that you can replace lost items without bearing the full financial burden.

Coverage in the Airport

- Travel insurance extends its protective reach even in the airport, covering missed departures, delayed baggage, and cancellations or limitations. This is particularly important for major trips, such as long-haul honeymoons or family visits to popular destinations like Disneyland.

Protect Your Adventures With Reliable Travel Insurance

Coverage Against Medical Emergencies

- One of the primary benefits of travel insurance is its coverage for medical emergencies. Whether it’s illness, injury, or the need for emergency medical evacuation, this coverage ensures that you receive necessary medical attention without the worry of exorbitant healthcare costs.

Trip Cancellation

- Life is unpredictable, and plans may change unexpectedly. Insurance protects your trip costs by covering the possibility of trip cancellation due to severe weather, personal emergencies, or flight-related technical glitches.

Lost Baggage and Loss of Passport

- Travel insurance offers coverage for lost, stolen, or damaged baggage, providing financial compensation for valuable items. Additionally, it assists in dealing with the inconvenience of a lost passport, ensuring your trip continues smoothly.

Additional Coverage Options

- Beyond core benefits, travel insurance often includes additional coverage options, such as injuries from adventure sports and compensation for home burglary during your trip.

Delayed or Canceled Flights

- Flight delays or cancellations are common travel annoyances, and travel insurance can compensate for losses incurred in such situations caused by the airline itself.

Accidental Death & Aviation Accident Coverage

- In the unfortunate event of death or serious injury during travel, insurance provides compensation for the policyholder’s family, acting as an additional benefit to existing life insurance coverage.

Loss of Money, Passports, or Important Documents

- Travel insurance can assist in recovering losses due to the loss of money, passports, or important documents, ensuring that you are not left stranded in a foreign country.

Investing in travel insurance is a wise and necessary decision to safeguard your well-being, finances, and overall travel experience. It acts as a reliable companion, offering financial protection and assistance when you need it the most. Don’t forget to purchase your insurance concurrently with your holiday booking, ensuring comprehensive coverage from the start of your journey.

What To Know Before You Buy Travel Insurance

Choosing the right travel insurance is a crucial step in ensuring a worry-free and protected journey. Here are some tips to help you make an informed decision:

Compare Companies

- Resist the temptation to settle for the first insurance policy you encounter. Take the time to compare different policies, paying attention to coverage limits, deductibles, and premiums. By doing so, you can identify the policy that aligns with your specific needs and budget.

Compare Policies

- Before committing to a insurance policy, meticulously read the fine print. Understand the coverage details, exclusions, and limitations to ensure you have a comprehensive understanding of what is and isn’t covered. This knowledge is vital in managing expectations and avoiding surprises in case of an emergency.

Buy Early

- Opt for purchasing insurance as soon as you book your trip. This proactive approach ensures that you are protected in the event of unexpected changes, cancellations, or disruptions before your departure. Early acquisition of coverage maximizes the benefits you can enjoy throughout the entire travel planning process.

Evaluate Coverage Limits

- Assess the coverage limits provided by the insurance policy. Ensure that the coverage is sufficient to handle potential medical expenses, ideally exceeding $100,000.

Adequate coverage should extend to both injuries and sudden illnesses, offering a comprehensive safety net for unforeseen health-related events.

Consider Emergency Evacuation and Repatriation

- A comprehensive insurance policy should include coverage for emergency evacuation and care. This is crucial in scenarios where you might require urgent medical attention, such as getting injured during a trek in a remote location. Confirm that the policy covers expenses related to transporting you to the nearest hospital or, if needed, repatriation back to your home country.

Check Coverage for Activities

- If your travel plans involve engaging in specific activities, ensure that the insurance policy provides adequate coverage for those activities. Some policies may require additional coverage for more extreme or adventurous pursuits, such as scuba diving, kitesurfing, or horseback riding.

Click now to explore travel insurance plans and ensure your adventures are stress-free

Coverage for Desired Countries

- Verify that the insurance covers the countries you plan to visit. Some policies may have limitations or exclusions for high-cost destinations like Japan or the United States. Ensure your chosen policy offers protection in all the locations you intend to explore.

Flexibility in Extending Coverage

- Consider travel insurance that allows for extensions while you are on the road. This flexibility is beneficial if your travel plans change, providing continued coverage as needed.

Protection for Valuables

- Assess the coverage provided for your most important valuables in case they are lost or stolen during your journey. Confirm the reimbursement process and coverage limits for personal belongings to safeguard against financial losses.

24-Hour Emergency Contact

- A reliable travel insurance policy should provide access to a 24-hour emergency contact number. This ensures that you can seek assistance at any time, especially in urgent situations where immediate support is required.

Cancellations Coverage

- Verify that the travel insurance policy includes coverage for cancellations due to unforeseen circumstances. Situations such as illness or unexpected events involving family members. This coverage ensures you are financially protected if your travel plans are disrupted.

Like this article read more from expat family living below!

Unwind in Paradise: Your Ultimate 7-Day Cancun Itinerary with EFL’s Expert Tips

Political Unrest and Emergency Situations

- Ensure that the insurance covers unexpected situations. This includes political unrest or emergencies that might result in the abrupt conclusion of your trip. Comprehensive coverage in such scenarios provides financial protection and assistance during challenging circumstances.

Online Claims Filing

- Opt for an insurance policy that offers the convenience of filing claims online. This streamlined process simplifies the claims procedure, allowing you to submit necessary documentation and receive assistance efficiently.

By considering these tips, you can make a well-informed decision when choosing the right insurance for your upcoming journey. This proactive approach ensures that you are adequately covered for a wide range of situations. Allowing you to focus on enjoying your travels with peace of mind.

In conclusion, selecting the right travel insurance is a pivotal decision that can significantly impact the quality and security of your journey. By following these essential tips, you can navigate the intricate landscape of insurance options with confidence and ensure that you are well-prepared for any unexpected twists your travels may take.

Remember, not all travel insurance is created equal. The key is to tailor your choice to your individual needs and preferences. Let the right insurance be your reliable companion, providing a financial safety net and ensuring that you can focus on creating lasting memories, free from the worries of unforeseen circumstances.

Travel insurance is essential as it acts as a financial safety net, get coverage now!

In the grand tapestry of travel, where the unexpected can be both thrilling and challenging. A well-chosen travel insurance policy becomes a thread of security, weaving seamlessly into the fabric of your explorations. So, embark on your journeys with confidence, armed with the knowledge that your travel insurance is there to safeguard your experiences and offer support when it matters most. Safe travels! Remember to follow your dreams no matter how impossible they may seem. Sabrina